Mortgage interest tax deduction 2020 calculator

If the total is larger than your standard deduction youll likely benefit from itemizing. On his Presidential campaign Senator Joe Biden proposed also imposing the payroll tax on every dollar of income above 400000.

Mortgage Interest Deduction How It Calculate Tax Savings

Which had them paying both halves of the tax.

. The limits on deductions for acquisition debt are far higher than for home equity debt. The 2020 standard deduction allows taxpayers to reduce their taxable income by 4601. You may only deduct interest on acquisition indebtednessyour mortgage used to buy build or improve your.

This calculator is for the 2022 tax year due April 17 2023. Income Tax Calculator. Use this federal income tax calculator to estimate your federal tax bill and look further at the changes in 2021 to the federal.

Is there a limit to the amount I can deduct. For 2020 the FICA limit is on the first 137700 of income. This will be the only land payment calculator that you will ever need whether you want to calculate payments for residential or.

Use our income tax calculator to find out what your take home pay will be in California for the tax year. You filed an IRS form 1040 and itemized your deductions. Please note that the self-employment tax is 124 for the Federal Insurance Contributions Act FICA portion and 29 for Medicare.

Estimate your provincial taxes with our free British Columbia income tax calculator. Yes No State and Local Taxes SALT Sales Taxes. Taxes are unavoidable and without planning the annual tax liability can be very uncertain.

For the year 2019-2020 the maximum TFSA contribution limit was 6000. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebt-edness. Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates.

If you itemize your deductions on Schedule A Form 1040 you must reduce your home mortgage interest deduction by the amount of the mortgage interest credit shown on Form 8396 line 3. Vacant Land Loan Calculator to calculate monthly mortgage payments with a land contract amortization schedule. For married taxpayers who file jointly its 25100 increased from 24800 in 2020.

See your tax bracket marginal and average tax rates payroll tax deductions tax refunds and taxes owed. Most BTL deductions are the run-of-the-mill variety above including several others like investment interest or tax preparation fees. Reducing your home mortgage interest deduction.

This is equal to 35 of assessed value after the Homestead Standard Deduction has been applied up to 600000 and 25 of assessed value over 600000. Home Mortgage Interest Form 1098. Since 2017 if you take the standard deduction you cannot deduct mortgage interest.

Add up all of these taxes but remember the IRS limits your state and local tax deduction to 10000. The FICA portion funds Social Security which provides benefits for retirees the disabled and children of deceased workers. Interest on Your Mortgage.

But the 2018 tax law no longer allows the deduction of interest paid. Acquisition debt comes from using a reverse mortgage to buy a house or refinancing debt that was acquisition debt. Mortgage Tax Benefits Calculator.

Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million 500000 if you use married filing separately status for tax years prior to 2018. For the 2020 tax year the standard deduction is 24800 for married couples filing jointly and 12400 for. If youre one of those landlords who possess a mortgage one of the largest homeowner deductions you can take is the interest payments on your mortgage.

The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage. You cant deduct any of the taxes paid in 2021 because they relate to the 2020 property tax year and you. However higher limitations 1 million 500000 if married filing separately apply if you are deducting mortgage interest from in-debtedness incurred before December 16 2017.

The mortgage is a secured debt on a. Fears of inflation continue to affect 30-year fixed mortgage rates which rose to 584 percent in Bankrates weekly survey of big lenders. 2 The limit on home equity interest deduction is not 100000 of interest but rather the interest on 100000 of home equity debt.

Average 2020 property tax rates in Tippecanoe. To qualify for a home mortgage interest tax deduction homeowners must meet these two requirements. These mortgage interest payments are 100 tax-deductible if you rent out.

The Supplemental Homestead Deduction is also for owner-occupied primary residences. Based on the Information you entered on this 2021 Tax Calculator you may need the following 2021 Tax Year IRS Tax Forms to complete your 2021 IRS Income Tax Return. For the tax year 2021 the deduction for single filers is set at 12550 increased from 12400 for the 2020 tax year.

Practically every homeowner will need to take out a mortgage to finance their property purchase. You cant deduct anything that pays off the original loan amount but any amount you pay to pay off. Check out our mortgage calculator.

Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 25100 standard deduction in 2021 which is worth 6024 in reduced tax payments. Its 18800 for those who qualify as. In 2021 and 2022 this deduction cannot exceed 10000.

Add your total state and local taxes capped at 10000 to the mortgage interest number you calculated above. Taxpayers who live in states that dont have an income tax are probably better off using their sales tax for the deduction. Yes No Charity Contributions.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Interest Tax Shield Formula And Calculator Excel Template

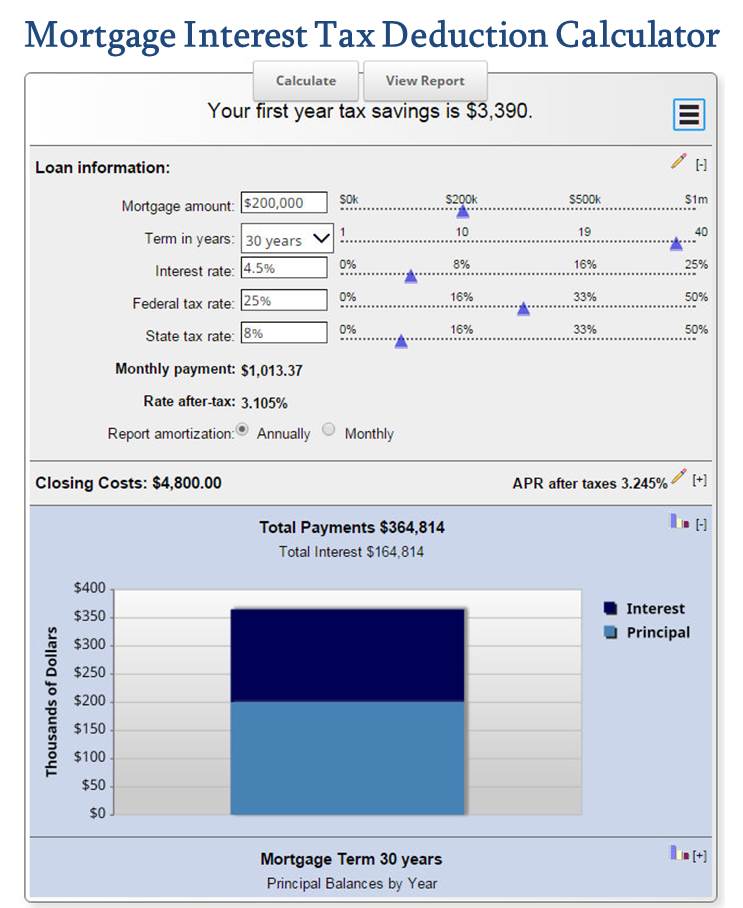

Mortgage Interest Tax Deduction Calculator Mls Mortgage

Mortgage Tax Deduction Calculator Freeandclear

Tax Credit Definition How To Claim It

Tax Deductions For Home Mortgage Interest Under Tcja

Mortgage Interest Tax Deduction Calculator Mls Mortgage

Home Ownership Tax Benefits Mortgage Interest Tax Deduction Calculator

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Turning A Mortgage Into A Tax Deduction For High Net Worth Individuals Talley Co

Your 2020 Guide To Tax Deductions The Motley Fool

How To Use Hauseit S Co Op Tax Deduction Calculator Youtube

Click Here To View The Tax Calculations Income Tax Income Online Taxes

Mortgage Interest Tax Deduction What Is It How Is It Used

10 Creative But Legal Tax Deductions Howstuffworks

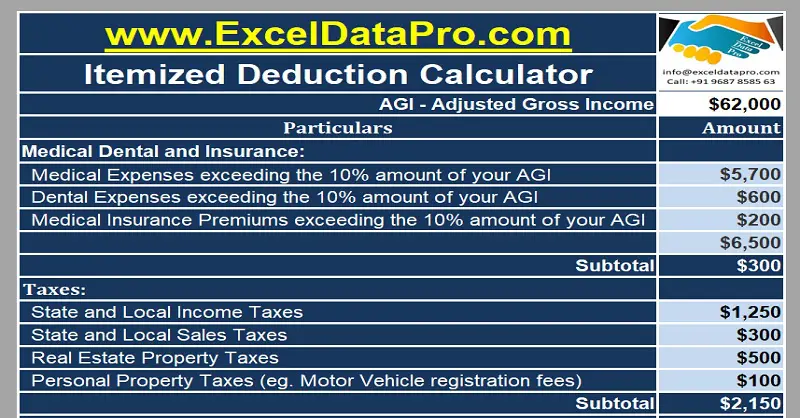

Download Itemized Deductions Calculator Excel Template Exceldatapro

Mortgage Interest Deduction How It Calculate Tax Savings